How to Honor Financial Milestones Without Breaking the Bank

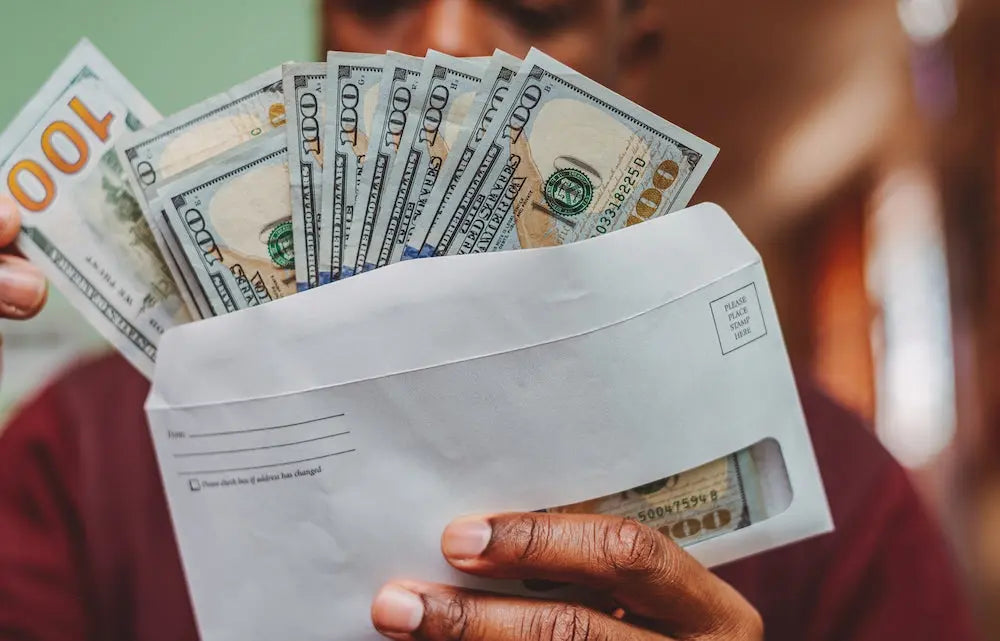

Achieving financial milestones is not just about reaching a goal; it’s also about recognizing the path that got you there. Whether it’s paying off debt, saving for a big purchase, or reaching an investment goal, each milestone deserves recognition. However, celebrating these successes shouldn’t mean setting yourself back financially. This article explores how to honor … Read more