The Rising Cost of Disasters

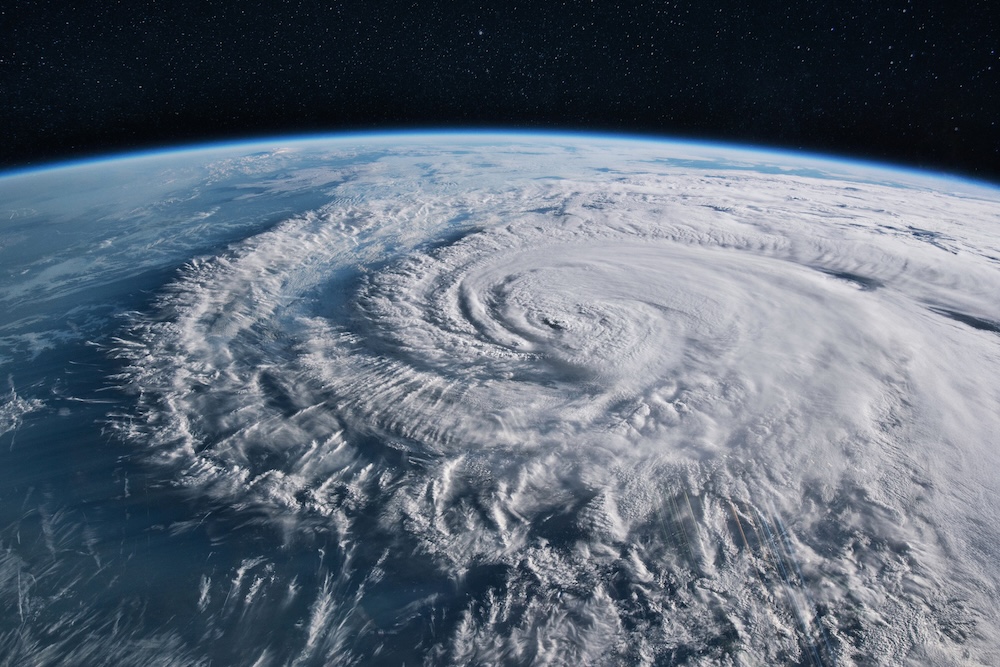

Climate-driven disasters are increasing in frequency and financial impact. Storms, floods, droughts, wildfires, and heatwaves now cause billions in economic losses each year. Traditional disaster relief models focus on rebuilding afterward, but very little global financing is directed toward prevention.

Green finance changes this model by channeling capital into projects that reduce risk, strengthen infrastructure, and build long-term resilience.

Why Funding Gaps Persist

Disaster risk reduction typically suffers from three persistent financial challenges:

Short-term incentives overpower long-term safeguarding

Governments, lenders, and developers often prioritize projects with quick returns. Resilience investments — such as flood-resistant infrastructure or long-term environmental restoration — take years to show measurable benefits.

Limited public budgets

Many countries, especially developing nations, lack the fiscal space to invest in disaster-resilient systems without external financial support.

High upfront costs

Critical improvements like sea walls, drainage systems, and grid upgrades require substantial capital that communities or municipalities cannot easily access.

Green finance directly addresses these barriers by structuring funding to favor resilience rather than reaction.

How Green Finance Reduces Disaster Risk

Investment in resilient infrastructure

Resilient infrastructure is designed to withstand extreme weather, absorb shocks, and reduce recovery time. Examples include:

- Elevated roadways and bridges

- Storm-resistant power grids

- Improved flood and drainage systems

- Water-secure irrigation and storage

- Wildfire-resistant land management

Green bonds, climate funds, and blended-finance structures provide the capital needed for these projects. Studies from the World Bank consistently show that every $1 invested in resilience saves between $4 and $7 in post-disaster losses.

Supporting climate-smart agriculture

Agriculture is one of the most vulnerable sectors in climate-impacted regions. Green finance helps farmers adopt:

- Drought-resistant crops

- Precision irrigation

- Soil restoration practices

- Early-warning and climate-monitoring systems

These investments improve yields, stabilize food supply, and reduce the financial shocks associated with crop failures.

Expanding renewable energy

Renewable energy strengthens disaster resilience in two major ways:

- Reduces emissions, lowering long-term climate risk

- Decentralizes energy production, improving grid stability during extreme weather

Solar microgrids, community wind systems, and battery storage solutions can operate independently during disasters, ensuring access to electricity for emergency services, hospitals, and communication networks.

Green finance reduces capital costs for these technologies, making them more accessible to vulnerable regions.

Benefits of Green Finance in Disaster Risk Reduction

Lower economic losses

When infrastructure, agriculture, and energy systems are built to withstand hazards, the cost of recovery drops significantly. Economies experience fewer disruptions to trade, housing, and essential services.

Stronger community resilience

Green-financed projects often include community-level initiatives, such as:

- Local emergency response training

- Community micro-insurance programs

- Early-warning systems

- Coastal restoration and wetland protection

This human-centered approach ensures preparedness and faster recovery.

Alignment with global sustainability goals

Green finance directly supports multiple UN Sustainable Development Goals, including:

- SDG 1: No Poverty

- SDG 7: Affordable and Clean Energy

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 11: Sustainable Cities and Communities

- SDG 13: Climate Action

By linking resilience projects with SDG outcomes, investors gain clearer impact metrics and governments gain stronger justification for new funding.

Examples of Green Finance in Action

Goldman Sachs

Through GS Gives and climate-focused philanthropic partnerships, Goldman Sachs has invested in initiatives that support disaster resilience, climate adaptation, and rapid-response infrastructure.

JPMorgan Chase

JPMorgan’s Environmental Finance Initiative mobilizes capital for renewable energy, energy efficiency, and climate-resilient infrastructure. The bank has committed hundreds of billions in sustainable financing to accelerate the global low-carbon transition.

Multilateral development institutions

Organizations like the Green Climate Fund, World Bank, and Asian Development Bank have created specialized financing windows for:

- Resilient coastal infrastructure

- Climate-smart urban development

- Early-warning systems

- Nature-based disaster risk solutions

These programs often blend grants, loans, and private investment to reduce risk for investors while maximizing impact.

Closing the Remaining Gaps

While green finance has accelerated progress, two major needs remain:

Broader access for developing countries

Low-income nations face the highest risk but often have the least access to climate-resilient financing. Expanding concessional lending and blended-finance solutions is essential.

Greater private-sector participation

Private capital remains underutilized in resilience projects because returns are long-term and benefits are sometimes indirect. Clearer metrics, government guarantees, and regulatory incentives can help unlock more private investment.

Conclusion

Green finance is reshaping how countries prepare for climate-driven disasters. By funding resilient infrastructure, sustainable agriculture, and renewable energy systems, it reduces long-term risk and strengthens the economic stability of vulnerable regions. As climate impacts intensify, green finance will continue to serve as a critical tool for building safer, more resilient communities worldwide.